DEBT - HOW ARE WE DOING?

WE ARE NOT DOING TOO WELL: In the last two years we have accumulated national debt at a rate more than 27 times as fast as during the rest of our entire nation's history. look at our miserable two year history. SEE THE TABLE ON THE NEXT PAGE; also see the rebuttal from the distinguished John Vallieres.

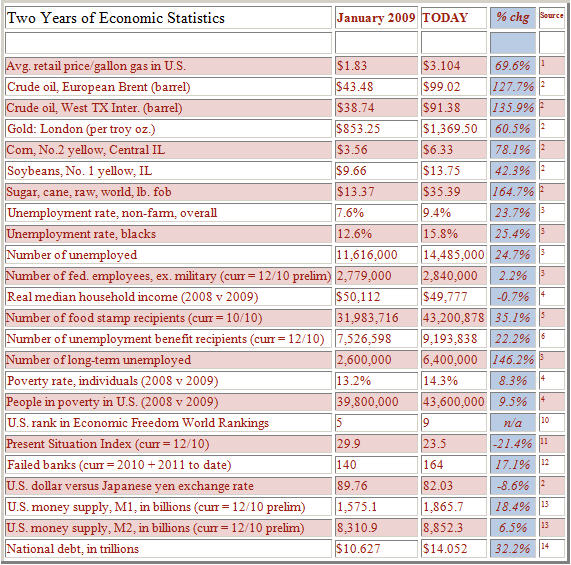

In the last two years we have accumulated national debt at a rate more than 27 times as fast as during the rest of our entire nation's history. look at this miserable history under obama

Two Years of Economic Statistics Under Obama

Sources:

(1) U.S. Energy Information Administration;

(2) Wall Street Journal;

(3) Bureau of Labor Statistics;

(4) Census Bureau;

(5) USDA;

(6) U.S. Dept. of Labor;

(7) FHFA;

(8) Standard & Poor's/Case-Shiller;

(9) RealtyTrac;

(10) Heritage Foundation and WSJ;

(11) The Conference Board;

(12) FDIC;

(13) Federal Reserve;

(14) U.S. Treasury

<br><br>

REBUTTAL FROM JOHN VALLIERES, ESQ

Hey, t’is the way of Democracy when we moved from a Republic form of government.

You get what you wish for. The majority of the American voters – I dear say the young, unemployed, unions, minorities, retirees with benefits beyond their just deserve – wanted what Obama promised. He is delivering for them. I can't say I voted with that group. Nor can I claim to have reaped any benefits from his election. I suspect the worst is yet to come.

Quod erat demonstrandum; fac me cocleario vomere!

John

PS I always liked the idea of granting voting rights to those who contribute to the common good, and only to them. The ability to earn 75% or more of the accepted minimum wage for individuals, and 66% for families is a criteria I would support as a base line for the right to vote. If you don’t contribute to a reasonable level you forfeit your right to demand more than the charity afforded to you. This makes good sense to me.

While I support a tax structure that is uniform for all, I am also in support of a structure that does away with all deductibles – charitable contributions, real estate, investment et al. A person who earns $25,000 a year should have no problem with being taxed $725; a person earning $1,000,000 should have no problem paying $250,000.

If the person making $25,000 falls below the poverty level, then social benefits are provided for. If below 75% of the poverty line, then no voting rights. This essentially is the meaning and spirit of a Republic form of government as I understand it. This addresses many concerns and serves as incentive for those who wish to contribute to society, while also providing for those who cannot by choice or chance. Those who do not contribute, should not, generally speaking, be afforded the same rights as those who do.

Right now it is my belief that the ‘common well’ is being drained dry by those who would take more from it than they deserve or are entitled to. I also believe that a man or woman who works with a pick and shovel does not merit the same reward as a man who pays them from his business efforts. Unions seem to believe that all workers are equal to those for whom they work. Odd to think about it. Risk must carry reward. Obama seems to have a problem with this idea.

God, I could go on. But I dear say I fear being accused of being a Republican at heart. Oh well.

No comments